Protecting

what’s

important today

and

securing your future

Personal Coverage

Business Coverage

Preferred A Rated Carriers We Work With

See our Reviews

Agency Blog

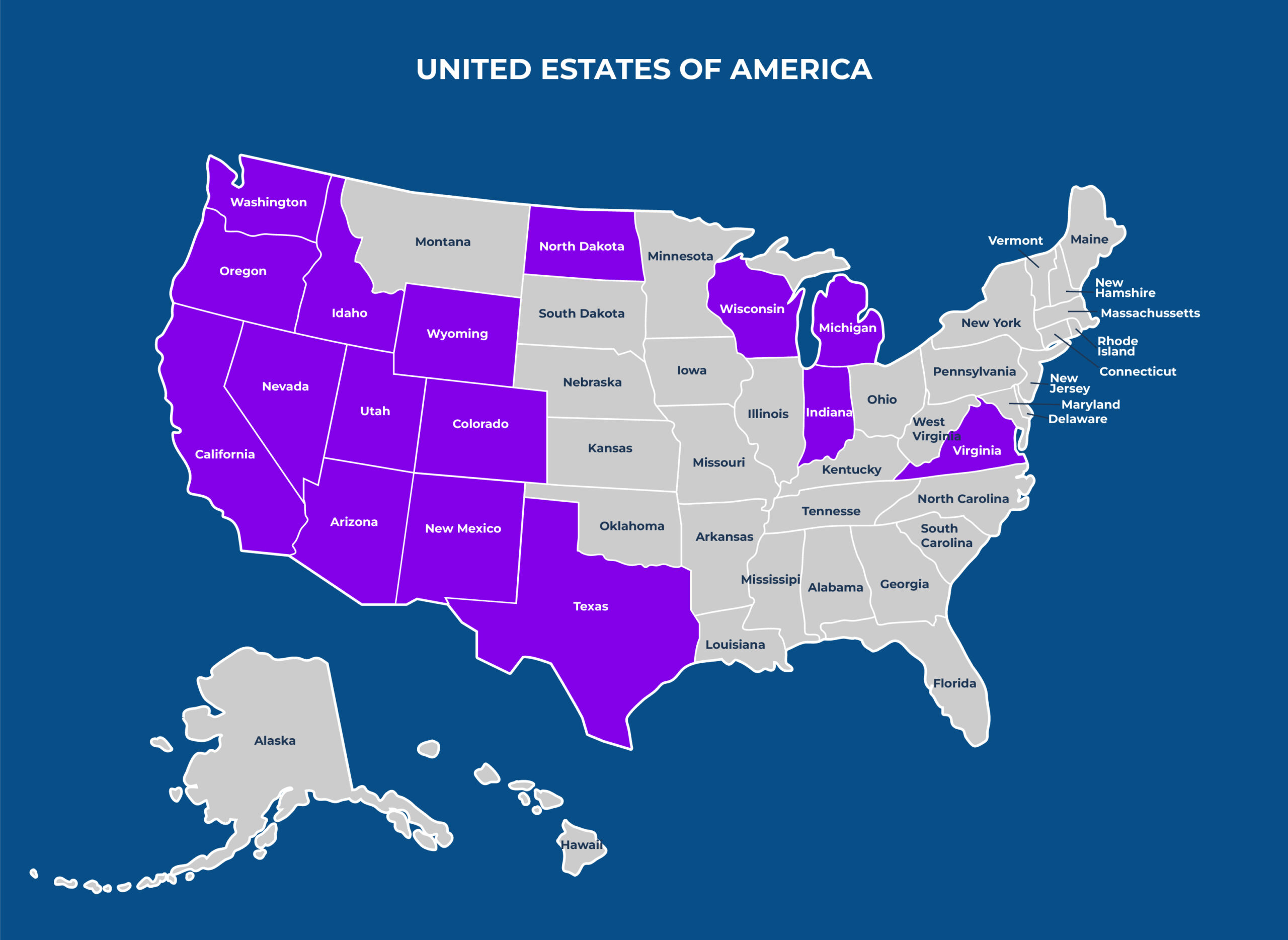

Where You Can Find Us

We are licensed in the States of: Arizona, California, Colorado, Idaho, Indiana, Nevada, New Mexico, Michigan, North Dakota, Oregon, Texas, Utah (resident), Virginia, Washington, Wisconsin, Wyoming.